What will be the value of multiplier K if MPC=MPS?

The multiplier’s value will be higher in such a situation. However, people will spend a smaller percentage of their increased income on consumption when the MPC is low. It means that the MPC determines the value of multiplier.

Whenever an investment is made, the effect is to increase income not only by the amount of original investment but by a multiple of it. The initial effect of an increase in investment expenditure is the increase in income by the same amount. Breadshaw, “The multiplier principle is that a change in the level of injections bring about a relatively greater change in the level of national income.” This again tells us that for every Re.

The producers of these goods will have an extra income of Rs 75 crore. If MPC of producers is also 3/4th, they in their turn will spend Rs 56.25 crore (3/4 of 75). So, this process will go on, with each round of expenditure being 3/4th of the previous round and in this way the production and national income will go on increasing round after round. The process of increase in income stops when change in income becomes equal to change in saving.

People often save money by keeping idle cash balances in banks. This idle money does not come into circulation and is unlikely to lead to an increase in consumption spending. The concept of the multiplier to be meaningful M PC must be greater than zero but less than one.

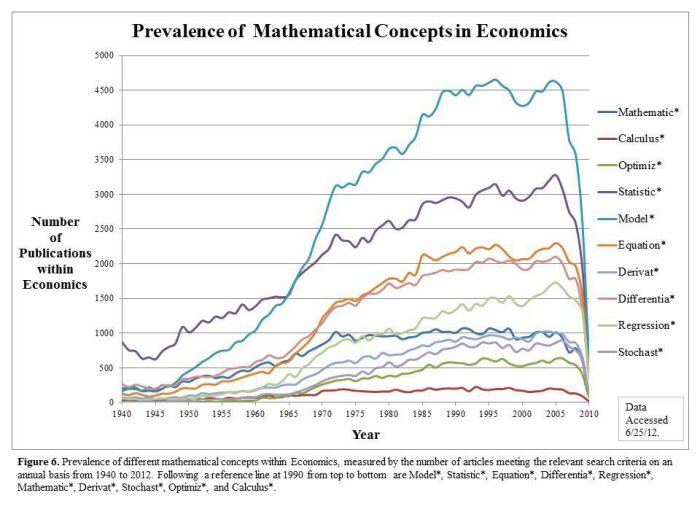

The theory of the multiplier was developed in the midst of the depression of the 1930s by Richard Kahn. However, he wrote about an employment multiplier in 1931. He observed the millions of unemployed and suggested that if more men are employed they would spend their wages. The decrease in equilibrium income is Rs. 200, Rs. 100, Rs. 80 and Rs. 40 for the four values of MPC. According to Samuelson, “an endless chain of secondary consumption spending is set in motion by a primary investment spending. But, although it is an endless chain, it is a dwindling chain.

He explained it with the help of the country’s investment and Gross Domestic Product . This means that any change in income (ΔY) will therefore equal (ΔC+ΔI). If MPS is high, K will be low but if MPS is low, K will be high as proved in the following examples. Let’s understand this whole process with the following table.

Money Supply Reserve Multiplier Example

This article has been prepared on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this article is for general purposes only and not a complete disclosure of every material fact. It should not be construed as investment advice to any party. The article does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information.

- The higher the investment multiplier, the more the investment will have a stimulative effect on the economy.

- Investment Multiplier topic is concerned with Determination of Income and Employment Unit of Macroeconomics.

- Foreign trade would result in importing of goods and government activity would result in taxation.

- But, although it is an endless chain, it is a dwindling chain.

As MPC is 0.80, the people spend 80% of the increase in income on consumption. This raises the income of the producers of consumer goods by ₹ 80 crores. In an economy planned saving is greater than planned investment. Explain how the economy achieves equilibrium level of national income. In the above figure , we have induced investment function which makes the investment curve upward positively sloping.

V. Long Answer Type Questions (6 Marks)

Or, in other words, it must be greater than zero but less than one. The numerical values of the multiplier in these three cases are 2.5, 5 and 7.5, respectively. This shows that the flatter the saving schedule, the larger the value of the multiplier. This theory assumes that the MPC remains constant.

The last impact highlight the true benefit of multiple effects. Although a single individual received a tax benefit, many companies and their employees benefited. For example, imagine the individual dined at a restaurant and left a tip. That tip would now be the benefit of the waitstaff who may buy maximum value of investment multiplier a crafted item at a local market and increase the income of a local artist. As currency flows through an economy, more than one individual or entity may residually receive benefit from a financial instrument. Therefore, the single tax benefit is said to have a multiplier effect on the economy.

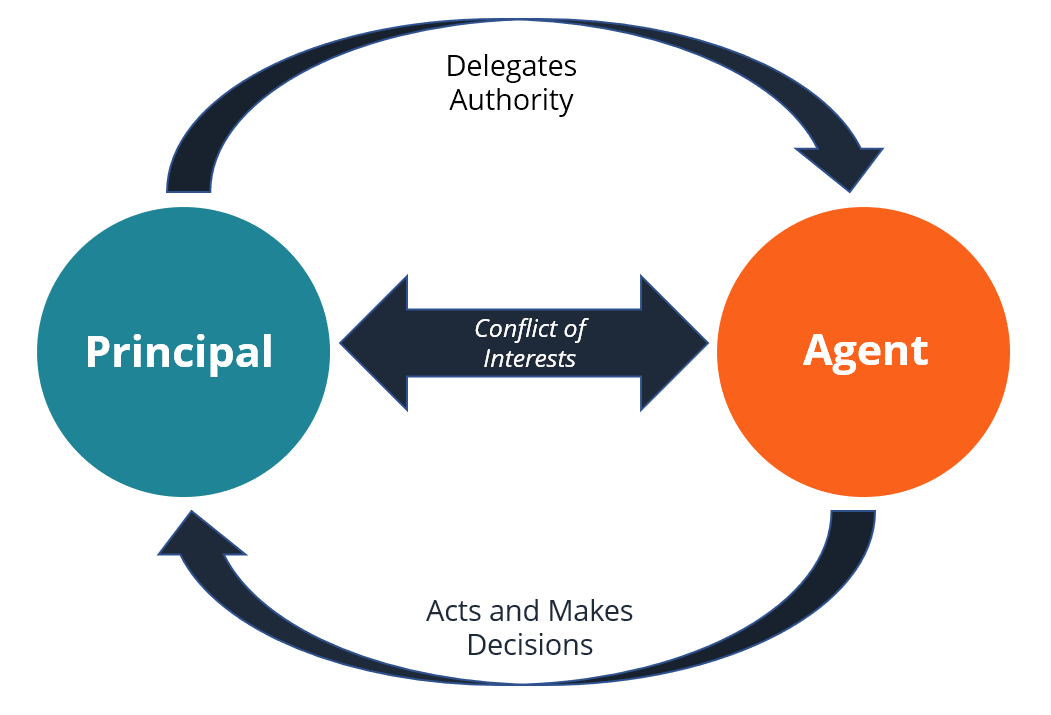

The process will continue for some time and at any stage of the process each successive set of recipients of new income spend 4/5 of their new income and save the rest. However, MPS is inversely related to the investment multiplier. This is because, a part of total income is saved and not consumed, leading to a reduction in the multiplying effect. Hence, Multiplier is the ratio of an increase in national income (ΔY) due to an increase in investment (ΔI). This can be further clarified with the help of an example. Keynesian economics comprise a theory of total spending in the economy and its effects on output and inflation, as developed by John Maynard Keynes.

According to Keynes, full employment is the economy’s inflation threshold. True inflation occurs only when the economy has just moved passed the stage of full employment. During inflation money income may rise but real income falls.

Therefore, after applying the multiplier effect , which resulted in multiples of 5, the real GDP would increase to $5,00,000. Marginal Propensity To ConsumeMarginal Propensity to Consume refers to the increase in consumption owing to the increment in disposable income. It is determined as the ratio of change in consumption (ΔC) to change in disposable income (ΔI). Inflation is the difference between the real GDP and nominal GDP.

An increase in bank lending should translate to an expansion of a country’s money supply. The size of the multiplier depends on the percentage of deposits that banks are required to hold as reserves. When the reserve requirement decreases, the money supply reserve multiplier increases, and vice versa.

Keynes’ theory of investment multiplier is considered to be an important and permanent contribution to economic theory. However, it is not only a theoretical concept showing the magnified effect on national income of a small change in autonomous investment. The concept has highlighted the importance of investment as the major dynamic element in economy. Let us now suppose that due to new investment of Rs. 1000 crores there is an increase in injections. As a result national income raises by Rs. 1000 crores immediately. The owners of factors directly and indirectly engaged in producing the investment goods will utilise Rs. 800 crores.

Higher the MPC, more will be the value of multiplier, arid vice-versa. The concept of multiplier is based on the fact that one person’s expenditure is another person’s income. Multiplier is the ratio of increase in national income (∆Y) due to an increase in investment (∆I).

Diagrammatic Presentation of Multiplier

The net result is a rise in employment in all of the affected industries. The change in income is greater than or a multiple of the initial change in expenditure. Following Keynes we may now consider a change in investment expenditure, which gives rise to the famous multiplier concept. The investments are the income for people that they will spend on consumption due to MPC. However, they wouldn’t consume the total income but save some part of the income.

NCERT Questions

Explain the process of working of the ‘investment multiplier with the help of a numerical example. Explain how the economy achieves equilibrium level of income using Savings-Investment (S-I) approach. If marginal propensity to save is 0.1, calculate the value of multiplier. As a result, the concepts of MPC and MPS are intertwined with this multiplier. A higher value of MPC will correspond to a higher value of investment multiplier and vice versa.

The Concept of Investment Multiplier

There is no lag between receipt of income and expenditure on consumption. For realizing the full value of the multiplier it is not enough for gross investment to be positive. Gross investment to the extent of depreciation always take place in any economy. But net investment or net addition to society’s stock of capital has to be positive. Explain briefly the effects on the equilibrium of this simple system, by introducing foreign trade and government activity.